You were once mesmerized by that smile. You got lost in those eyes. Just being near him/ her was enough and you just couldn’t get enough of him/ her. He/she was like the most delectable feast for the eyes. The perfect apple of your eye. All you saw in this world was this unique apple, nothing else. But as time elapsed, you start to get used to his/her presence. That smile and those eyes weren’t as special as they once were. The relationship morphed to one which is stable but predictable and boring.

The problem with stability is that it tricks our brain into looking for stimulation. The brain loves surprises. It craves excitement and new experiences. It’s how we humans are wired. The problem with this natural tendency is it leads us into believing that the relationship is somehow flawed because the feeling of excitement and intense passion has faded. Some seek excitement outside their relationship, and some end theirs out of boredom. Several just stick around hoping things will get better. But the predictability of it all eventually takes its toll.

However, when it comes to managing money and investments, behaving in that fashion could be the proverbial recipe for disaster. Or could lead to just plain impaired performance. Predictable is boring and lack of variability dull. But in our world of investing, these are virtues to be preserved and treasured. It is proven empirically that these enhance portfolio performance over the long term or over what we might term appropriately as our life-time horizon.

Through the daily hurly-burly of investing, we often spend an inordinate amount of time doing difficult things like poring over excel sheets, about which Charlie Munger had this to say: “People calculate too much and think too little”. It is one of his many quips that have stuck in our minds. We draw inspiration from it for the manner in which we go about ferreting businesses and stocks to invest in.

While poring over excel sheets and annual reports is de rigueur for most of our ilk, one of the most important aspects of our stock selection process is to look for companies and businesses that have a stable earnings trajectory that is likely to continue into the future. Note: “stable” should not be construed to be growth-less earnings. We are convinced that high predictability accompanied by low volatility of earnings is a much under-appreciated tenet in investing. Developing markets – where inefficiencies are higher than in developed ones – are fertile territory, with bargains to be had at all levels of the market.

It is well understood that equities are riskier than bonds because net equity earnings represent what remains after everyone else has been paid and are therefore more volatile than operating earnings. But what if you find companies that have earnings that are more stable? The stocks of such companies should become safer to own, thus lowering the risk of owning them and are therefore potentially better investments. If you could make returns on stocks in such companies that are comparable to what you would make on stocks in firms with more volatile earnings, you could argue that you are getting the best of both worlds – high returns and low risk. There are two thoughts that need some explaining.

- Stocks with stable earnings are less risky than stocks with volatile earnings: For this to work, you have to accept the idea that volatility in equity earnings is a good measure of equity risk. The alternative measures of risk used in finance such as stock price volatility or betas are market-based measures. To those investors who do not trust markets (for instance, because they feel that markets are subject to mood swings and speculation), earnings stability or the lack thereof seems to provide a more dependable measure of equity risk.

- Stocks with stable earnings generate less volatile returns for stockholders: According to this argument, firms with stable earnings are less likely to roil markets with earnings announcements that surprise investors. The resulting price stability should make the returns on these stocks much more predictable than returns on the rest of the market, especially if the firm takes advantage of its more stable earnings to pay larger dividends.

The question then is: how do we go about building a portfolio of companies or find as many companies as possible which have low earnings volatility and high predictability that we can then buy in our portfolios?

We usually start by analysing a business’s inherent character and identify the parts of it, if any, that impart volatility to its earnings and create unpredictability. Once we have got a fair understanding of these two aspects, it is easy to know whether or not one wishes to own the stock at all. Once we have got past this, it comes down to the financials and estimation of earnings and what price one pays for it.

There is nothing wrong in owning a business which has some degree of volatility or unpredictability. In fact, a vast majority of listed companies would have the more volatile and less predictable kind of businesses. One must then demand a higher margin of safety in terms of the valuation one pays for it, to be assured of zero or minimal permanent loss of capital should the company ‘miss’ earnings or underperform expectations in the short to medium term.

Sources of Earnings Volatility

- Volatility could arise because the selling price of a company’s product and the input costs to produce it fluctuate widely at short to medium intervals. Companies which produce commodity products such as metals and mining, steel, chemicals, plastics, etc. are good examples. Commodities are globally traded and hence companies’ fortunes swing back and forth with their prices.

- The second kind of earnings volatility could come from fluctuating demand for the products. Demand fluctuates due to various reasons, driven by external or macro-economic factors, substitution by other products, etc. Large demand-supply imbalances in industry capacity can depress or inflate prices, leading to short and medium-term spikes in revenues and profits. Automobiles, auto-components, airlines, shipping and even capital goods to some extent fall in this category.

- Industries where technological advancements happen rather rapidly, such as mobile phones, computer hardware, software, etc. also see sales and earnings swing sharply as fortunes are made and lost pretty quickly with every new technological change. The earnings trajectory changes happen over a slightly longer period of time but their magnitude can be quite large and swift when it happens.

- E-commerce is another sector where the landscape is shifting so rapidly that through the growth cycle, earnings volatility is an integral feature for most companies. Because of low entry barriers in many areas and/or easy availability of funding in many sub-segments, competition is fierce, leading to even incumbents being subjected to low earnings visibility and unstable trajectory of their growth. Chinese internet companies are prime examples.

- Lastly, there are businesses whose products and services are paid for by their customers after a long time lag of receiving them. Their earnings instability and lack of visibility emanates from lumpy order bookings and executions and hence uneven revenue bookings and long working capital cycles. Construction companies, real estate developers, EPC contractors, etc. fall in this category.

The Obvious Targets

What kinds of businesses then enjoy the kind of high earnings visibility and lower volatility in their reported earnings that we seek? The most obvious of these are industries which are usually well-regulated such as telecommunication providers (telcos), utilities and toll-roads. Besides these, IT-services, consumer staples, some consumer discretionary businesses such as media companies, high-end luxury branded goods, certain segments of financial services such as insurance, equipment leasing also conform to such characteristics. While there is an element of cyclicality to all these businesses too, the amplitude of their earnings variability tends to be much lower.

Traits of Less Volatile and Higher Visibility Businesses

We find that our preferred kind of businesses have some common traits – they possess lower variability in their gross and operating margin profile and low capital intensity and leverage on their balance sheet. More importantly from an investment standpoint, they are high cash flow generators and they consistently pay this out through dividends. Companies which grow cash flows and have an ever increasing dividend stream are the best in class and most sought after by long term investors.

Consequences of Low Volatility of Earnings

While we have established the virtues of low volatility and high visibility of earnings, the outsized upsides that some types of investors seek are often missing. Stock returns from such companies tend to be moderate but more stable over a longer period of time versus others. This impacts the price performance of such companies in the following ways:

- Stock price discovery: Since earnings are largely predictable, the market quickly figures out the fair value range and hence stock price gyrations tend to be subdued. Traders dislike such companies.

- Lower beta: As earnings growth is sedate and may not accelerate or decelerate too much, in fast rising markets such stocks lack price momentum and could underperform relatively; they consequently have lower betas.

- Higher valuations: Several if not all such stocks enjoy a premium to market in terms of valuation metrics arising from lower risk premiums associated with the high predictability and lower volatility of their earnings.

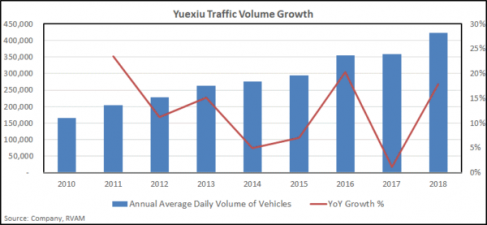

Over the last few years, we have owned and continue to own a fair share of such companies in our portfolio. A long term holding for us has been a toll-road operator Yuexiu Transport Infrastructure. This is a business whose growth is dependent on traffic growth and toll-rates.

While the former ebbs and rises mildly but grows year over year, toll rates are regulated and stable imparting solidity to its revenues and some operating leverage has led to its margins inching up over time. The high cash generation leads to prodigious FCF and dividend yield on the stock.

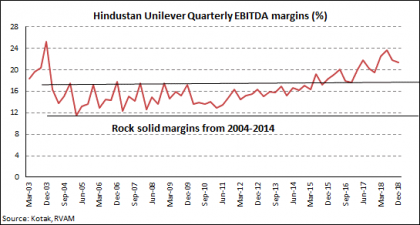

Another example of a company which has demonstrated significant strength is Hindustan Unilever, listed in India. It is the largest consumer staples company in India by some distance. Anyone who has tracked it over the last two or three decades will know the unbelievable stability of its profit margins and the resilience of its revenue growth through good and bad times.

Such has been its strength that since recently in 2015, it has seen its profit margins inflect higher, not lower, as many sceptics would have expected, in spite of the market becoming more significantly competitive.

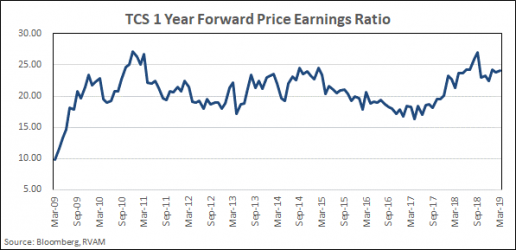

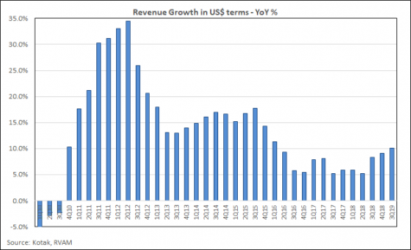

Indian IT services companies are another breed of such companies. Our affinity for them stems from the fact that they have a certain trajectory of growth which is connected to industry growth, and most well-run companies do not fluctuate much on either side. Take a look at the largest TCS Ltd., among the world’s leading IT services companies and a true global champion. Its revenue growth and consistency since the end of the GFC in 2009 are nothing short of spectacular for a company of its size.

This consistency has some cyclicality impinged as it is by the ebbs and flows of global growth. Yet the stock’s P/E multiple over the past decade has fluctuated between what is now a well-defined band of about 16 to 27. As investors, it is valuable to know what the market pays in its sweetest of times and when things sour for it. These are well correlated to the undulations of its earnings performance.

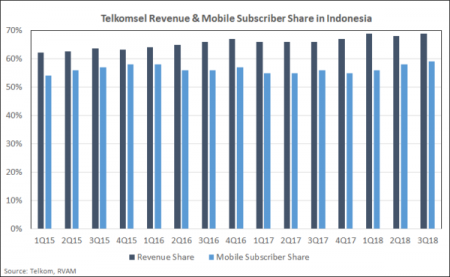

In Indonesia, we have another model of solidity in Telkom Indonesia. This company owes its stability to its ownership, size and clout in the country’s economy. Yet, unlike several other examples like itself in Asia and the world, Telkom Indonesia has held its ground and defended its business stoutly.

Take a look at the chart here, of its revenue share and mobile subscriber share. It is not surprising that a vast majority of buy and sell side folks we meet tell us that it is the only telco worth owning over the long term in Asia. The stock’s valuations and performance speak for themselves.

To summarise then, our conviction has been to populate our portfolio with a large number of businesses which have higher predictability of revenues and earnings and lower volatility around them over cycles. By doing so, we strive to lower the volatility of the performance of the portfolio and impart stability to its growth trajectory over the long term.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.