As the world view on forward growth is becoming more positive, especially for developed markets, it is important to revisit our original thesis of economic and corporate earnings growth being poor in the medium to long term. This is an important leg of our long term macro construct and hence needs to be regularly revisited.

Components of stock return

Stock return = Earnings growth + PE movement + Dividend + Buy backs

Dividend + buy back (and their source – “Free Cash Flow”) have been discussed earlier, hence I will leave them alone this month.

On the former two (Earnings growth and PE re-rating), our case has been that compared to the past two decades, they will be less important contributors of future stock returns.

Earnings growth: This has been the largest component of total stock returns in the longer term (closely followed by dividends), but it has had large enough periods of low return contribution.

Earnings growth = Revenue growth x Change in corporate margins

Revenue growth: This is broadly driven by GDP growth. We have made the case earlier about how a reversing interest rate cycle will act as a permanent millstone on growth over the next decade. This is a simple but powerful argument.

Corporate margins: The new point we are making is on corporate margins.

Corporate margins are at a historic high

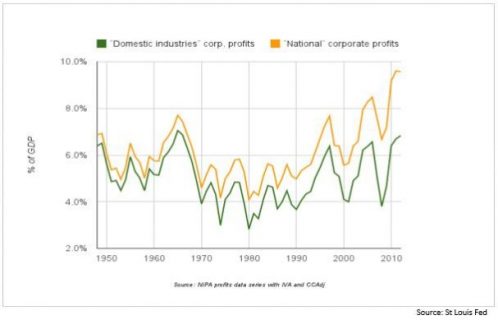

If we define Corporate margin as approximately equal to Corporate profit/GDP, then this ratio is way above historic peak (see orange line in the chart below – we are considering US markets as representative of the global corporate sector). Even if the international profits are taken out, the number is at a historic high (see green line in the chart below). In either case there is not much room for upside based on history.

There is a natural tendency for capitalism to work, hence this high margin should attract more capital and competition and consequently lead to its normalisation. The margin drop can happen for multiple reasons: increasing wage cost, higher taxation, negative operating leverage because of slower growth, increased competition because of high margins, higher interest costs, etc. All of these factors, which incidentally are each now at historically favourable levels, will be significant contributors to margins dropping from the current levels.

This margin drop is the biggest risk to earnings growth going forward. Combine this with a lower GDP growth (and hence lower revenue growth) and we have a situation where earnings growth will struggle to beat long term averages.

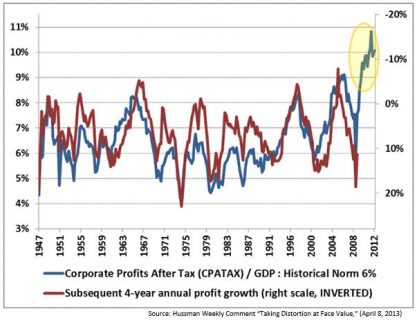

Historical negative correlation between corporate margins and forward earnings growth

Finally, we look at history in terms of forward profit growth and corporate margins. There is a very high negative co-relation between corporate margins and forward earnings growth (as can be seen from the chart below). For example in 2006 when margins peaked at about 9%, the next 4 years’ earnings growth was -5% p.a. Similarly in early 2009 when margins bottomed at about 5%, the following 4 year profit growth was over 10% p.a.

According to this chart we are at a historic peak in margins. This is therefore another reason to believe that forward earnings growth will be anaemic.

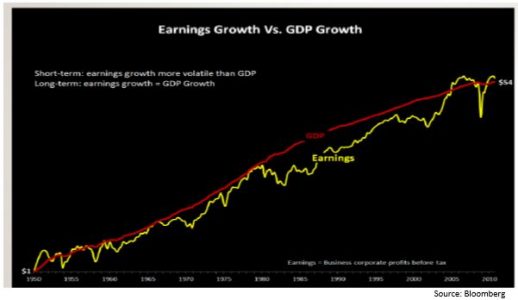

Slower GDP growth will be a drag on corporate earnings growth

Also, though market participants say that corporate earnings and GDP do not coincide, this may only be true in the short term. In the medium to long term they track each other closely (as seen in the chart below).

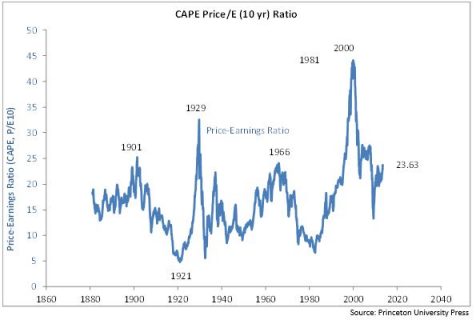

Valuation (PE) looks full

On valuation we make a case that we are at the higher end of historic trading ranges. Let us look at the Cyclically Adjusted PE (CAPE).

CAPE = (Market capitalisation on today’s price) / (Last 10 year average of earnings on today’s price)

This ratio, propagated by Robert Schiller, is well regarded as a more stable and longer term measure of valuation than pure headline PE. This number is at the higher end of the range of the past 145 years except for the five years between 1997 and 2002 (see chart below). This is a powerful pointer to the conclusion that forward valuations have limited upside.

Conclusion

In conclusion, we continue to believe that the medium term stock return environment remains mediocre. The ability of the central banks to unwind the liquidity infusion done over the years will be low as the consequent high interest rates will be unpalatable given the high current leverage in the system. Any attempt to unwind will quickly lead to lower growth and force the central banks to re-start their easy monetary policy. Therefore our belief is that we will trundle along with the low growth/ low interest rate environment for the foreseeable future. In this environment, strong free cash generators with solid though mediocre growth will be increasingly valued by the markets.

Two quotes:

In this environment of garbled and confusing macro drivers, this quote from Charlie Munger in the last Berkshire Hathaway annual meeting seems apt:

“If you are not confused about the economy, you don’t understand it very well.”

On the other hand, for those who say that “in theory the dividend policy of a corporate is not material”, here is a quote from Yogi Berra:

“In theory there is no difference between theory and practice. In practice there is.”

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.