The last issue on anybody’s mind after having lived through a decade of deflation and now facing an unprecedented economic shock induced by the coronavirus, would be the return of inflation. But then we have been living through extraordinary times. Markets have yet to come to grips with new paradigms and phenomena brought about by unorthodox central bank policies: rather than sticking to their traditional “lender of last resort” role, central banks now act to stabilize financial markets at the first whiff of economic trouble. The liquidity sloshing around is creating interesting cocktail circuit buzz, like the recent episode of retail investors using Reddit message board Wallstreetbets to take on deep-pocketed hedge fund shorts on Gamestop using Robinhood accounts; the saga has been copiously documented in the press as a tale of David versus Goliath, “revenge of the small investor”, etc. Instead of getting caught up in bubble speculations, we look this month at opportunities and challenges brought about by the liquidity-induced boom we are currently seeing in commodity prices and the risk of it being a harbinger of structural inflation.

Last month’s newsletter outlined the path to a $100 trillion global economy. Our guest author postulated there that the global deflator (inflation proxy in GDP data) could stay elevated in the 2-4% range for the next few years, driven by stimulative fiscal and monetary policy by most of the large world economies. This month we elaborate more on the drivers of this inflationary phenomenon and how to position investments to benefit from them.

Inflationary Risks

Inflation is a measure of the rate of increase in prices of goods and services in an economy. It can occur due to cost-push factors like increase in cost of production or demand-pull factors like the willingness of consumers to pay more. Many times, a combination of circumstances can lead to an imbalance in demand-supply, leading to dislocation and to market participants adjusting prices to reflect underlying trends. The coronavirus shock was initially seen as a deflationary force impacting demand across sectors, but the rapid fiscal and monetary intervention in every major economy in the world has supported income and asset prices, resulting in a quick recovery of demand. On the other hand, in the near-term, the supply side of economic activity continues to remain disrupted, either due to prolonged lockdown in many regions of the world or due to trade disruption caused by pandemic measures. From a longer-term perspective, we are seeing champions of protectionism gaining the upper hand in most economies: policy makers, having learnt lessons from critical equipment shortages during the heights of the crisis in 2020, are trying to build local capabilities not only to satisfy basic demand and but also to protect local jobs impacted by the coronavirus dislocation. Globalization, which was a deflationary force for the last couple of decades, seems to be in retreat.

The liquidity boost from ultra-loose monetary policies across most of the major economies is driving speculation in not only asset prices but has also spilled over to commodities at a time when supply disruptions are tightening the demand-supply equilibrium. Over 2021, we are likely to see this drive price increases for consumer goods, as strong demand gives enough justification for producers to pass through cost increases.

Monetary Boost

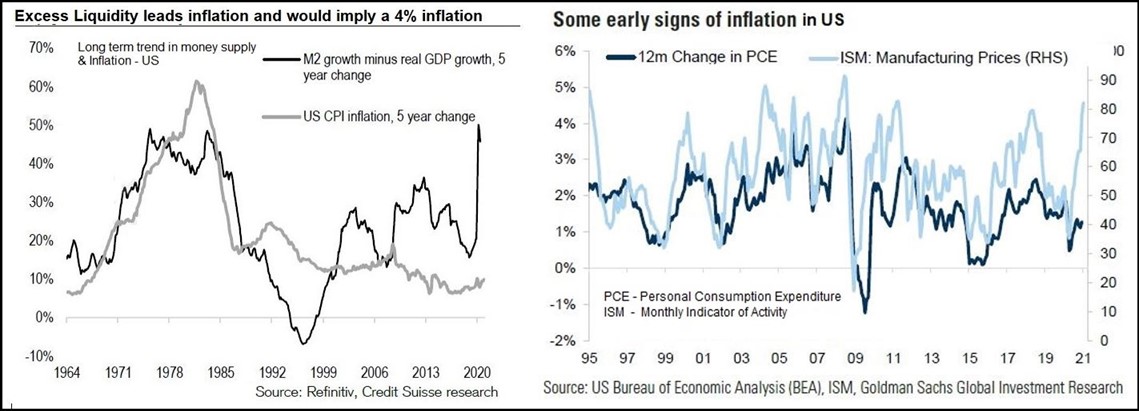

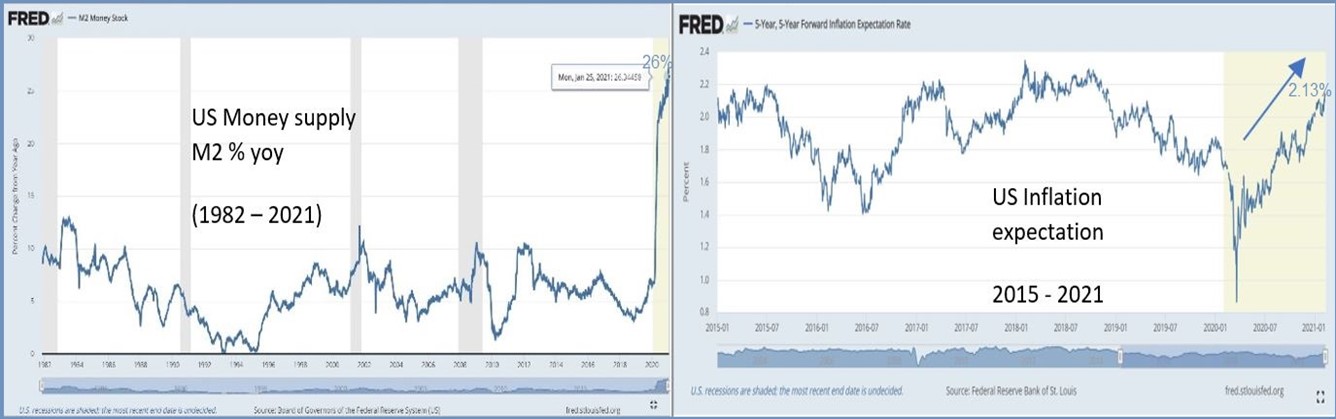

Milton Friedman, the Nobel Prize winning economist, made the oft-quoted proposition: “Inflation is always and everywhere a monetary phenomenon”. After a couple of decades of stable inflation, the simultaneous monetary stimulus unleashed by the central banks of large economies (the U.S., Europe and Japan), to tackle the fallout of the coronavirus pandemic is going to retest the hypothesis. In conventional times, the two mechanisms through which monetary policy potentially affects inflation are through narrowing the output gap and through raising inflation expectations. Compared to underlying economic activity, money supply in most economies in the world today is in an overshoot, thereby boosting demand. On the other hand, normal supply has been disrupted by uncoordinated lockdowns in various countries. This has resulted in a distortion in the short run equilibrium. To the extent that it is transient, the flow through impact on prices and inflation will be short term. The charts below show the trend in money supply and inflation in the U.S.

The chart on the left above tracks the long term (5 year) trend in money supply relative to economic activity and inflation. The ballooning of M2 in the U.S., the largest economy in the world, over the last nine months is unprecedented not only in the short term but also when one looks at long term trends. The chart on the right above shows inflationary pressures building up in the U.S. as manufacturing prices react to quickly normalizing demand as well as increases from rising input costs induced by supply disruptions. The rapid pace of money supply growth over the last year can be gathered from the chart on the left below while the chart on the right below shows how inflationary expectations, which fell in the wake of the pandemic, are quickly moving back up, reflecting the loose monetary conditions.

The boost from low rates and loose monetary policy is leading to speculative rallies in not just asset markets but seems to be spilling over to commodities, which can start a self-reinforcing inflationary spiral as rising input costs boost prices in a period where demand has recovered, helped by fiscal income support measures, way above the equilibrium rate justified by level of wages and economic activity.

Commodity Rally

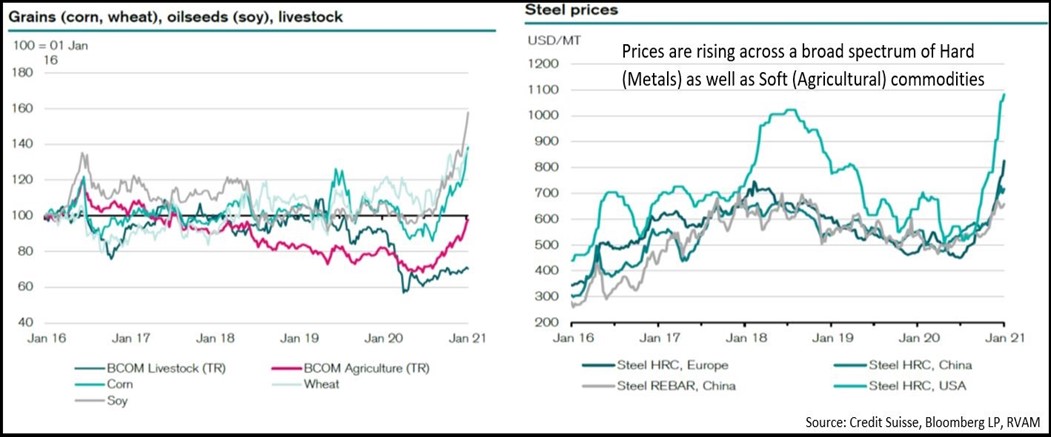

Commodity prices have been on a tear since the middle of last year. What started with an early recovery in activity in China, as its economy normalized from COVID-19-induced lockdowns, continued as demand picked up momentum in most parts of the world, helped by government fiscal support measures. With supply struggling to catch up with demand due to restrictions in movement in many parts of the world, the tightening demand-supply dynamics have attracted speculative capital into the commodity space. Price increases have been seen across board whether in soft agricultural commodities or hard economically-sensitive products like metals and oil (see chart below). In many cases, prices currently are running way above previous cyclical highs, even though global GDP is still significantly below levels of activity seen just before the onset of the pandemic.

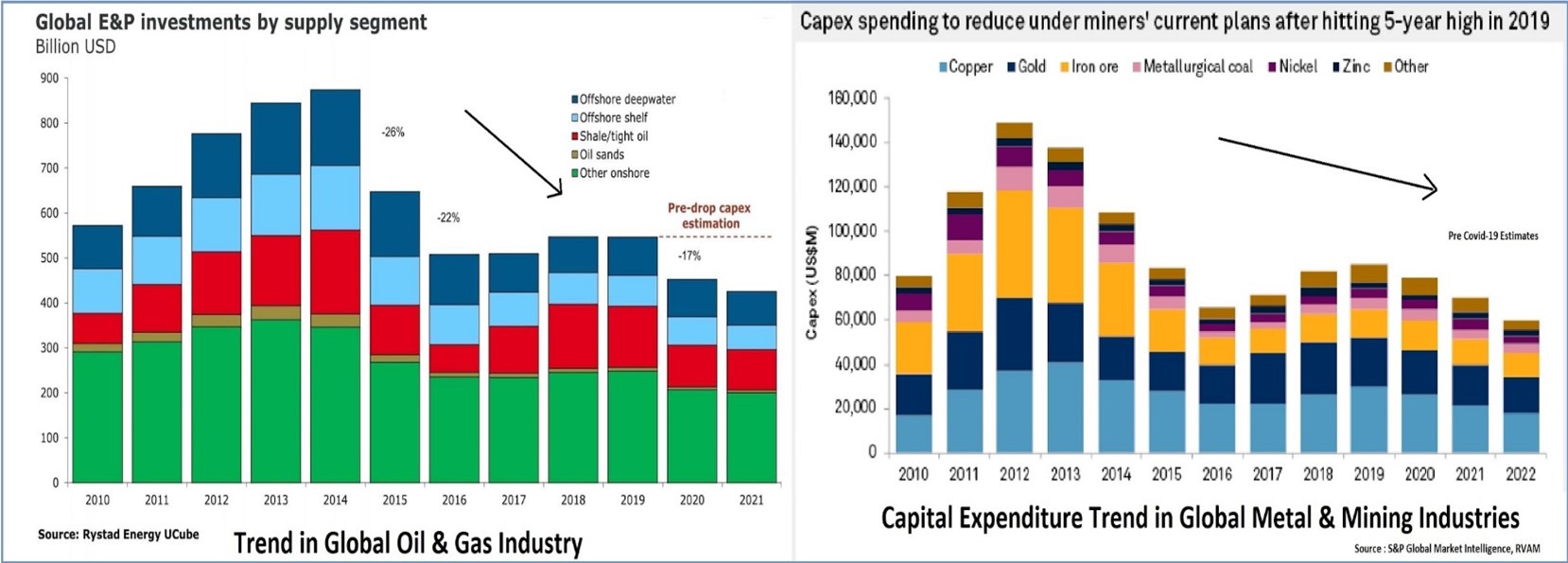

The global liquidity boost to asset prices makes one cautious about extrapolating current trends, especially as near-term prices continue to be supported by supply bottlenecks which could abate as economies open up once a large part of the vulnerable population is vaccinated. On the other hand, there are reasons to worry about long term supply, as commodity sectors have seen a structural decline in capital spending since the middle of the last decade. The chart above shows the falling investment spending trends across two large segments of commodity industries: energy and mining.

Companies operating in these industries have been under pressure from ESG-aware investors to become better corporate citizens by focusing on the outcome of their activities and improving governance, in addition to improving shareholder returns in a declining commodity price environment. Consequently, even before COVID-19, there were arguments being made that we could see a supply shortfall due to insufficient investments to satisfy the long-term trend of rising demand. A strong recovery in global GDP in 2021/2022, on the back of government support programs, could see the current tight supply-demand situation continue for a longer-than-expected period.

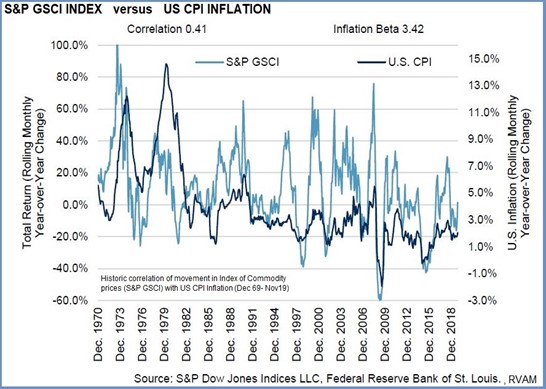

Before we consider ‘higher for longer’ commodity scenarios, we should touch a bit on the inflationary implications of a commodity rally. The chart alongside shows the historic correlation between GSCI commodity index and US CPI inflation. Going by past experience, it is likely that we will be seeing a passthrough of the recent rally in commodity prices into inflation. The magnitude of rise is likely to depend on the longevity of the current rally. If prices sustain at current levels without coming off, past data would suggest a rise in inflationary expectations to the 2-4% range. A commodity super cycle, which is not a current market expectation, could take inflation a lot higher and, to that extent, we think it is worth exploring the case for a prolonged commodity price rally.

Super Cycle Thesis

One of the side-effects of the pandemic has been rising awareness of environmental and social issues, which is reflected in the greater acceptance of ESG frameworks not just among investors but also among individuals. The election of Biden as the U.S. president has brought “climate change” back to the centre stage of U.S. policy making, after four years of assault by the Trump presidency. The re-entry of the U.S. into the Paris Agreement gives greater heft to the global pledge for a carbon neutral world by 2050, which till recently seemed a purely European project. The real-world implication of the climate neutrality pledge is a rising demand for investment across a whole host of environment-friendly technologies, whether they be new sources of energy, or cleaner forms of transportation, efficient buildings, higher recycling, etc.

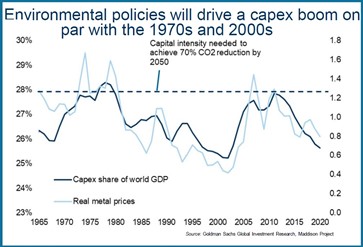

The world not only needs to change current patterns of consumption but also needs to invest to ensure society can continue with its current level of progress using alternate technologies. Goldman Sachs’ Carbonomics study estimates that the world will need to invest $16tr on capex over the coming decade to achieve its environmental pledge. The chart alongside shows that this level of incremental capex intensity is akin to periods of previous “commodity super-cycles”, the most recent one being driven by BRIC’s boom in the 2000’s. The key driver of this is higher intensity: investing in green infrastructure is 1.5 to 3x more capital- and job-intensive than investment in a unit of traditional energy source.

A lot will depend on economic policies adopted globally in a post-COVID-19 world. As activity normalizes, if governments start withdrawing stimulus measures, we could see a quick cooling off of the current tight supply-demand conditions. On the other hand, many observers make the argument that it is going to be difficult for politicians to step back from stimulus in an era where redistribution is increasingly becoming the mainstream political narrative due to widening income and wealth disparity.

A stimulative demand situation in a tight supply environment, with rising demand for investments into newer technologies to meet the climate pledge, can set the world up for the next commodity super cycle. Only time will tell the outcome of various competing factors which interact to deliver the final commodity prices which will impact all our lives. Irrespective of how the world ends up, we continue to see plenty of opportunities to invest in Asia.

Impact on Asia

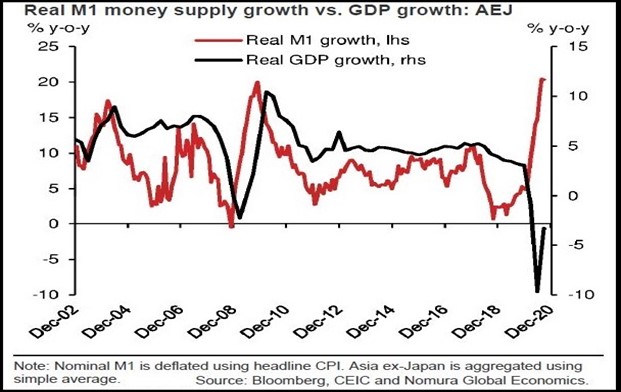

In our November 2020 monthly The Resurgence of Asia, we looked at not only the benefits of handling the coronavirus pandemic better but also commented on the flow through benefits of the emerging global liquidity surge. The chart alongside shows how strong money supply growth telegraphs a rapid real GDP growth over 2021-22 in Asia ex-Japan.

Not only is Asia in a better position to benefit from post-COVID-19 global growth recovery, but the commodity boom which we highlighted earlier in this piece also has significant economic benefits for parts of South-east Asia like Indonesia and Thailand where a significant portion of the rural population depends on soft commodities to earn a livelihood. Historically, we have seen consumption booms in these countries during periods of elevated commodity prices.

As market participants we cannot be immune to the bull market frenzy going on in certain parts of the marketplace. It naturally raises questions of “what if the bubble bursts”. To the extent one is not involved in those parts, it is not relevant, though as we have stated many times in past write ups, it will create volatility which as professional investors we need to navigate. But every episode of volatility also leaves behind in its wake a plethora of opportunities. An astute investor is one who is aware, willing, and able to grab them.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.