The selloff of certain kind of assets in the past four months has mostly been predicated on certain assumptions. The market’s chain of thought has been: the US is growing well, the US labour market is improving, these are driven primarily by a recovery in the US property sector and hence the Fed has to start reversing the QE of the past few years. Add to this a stabilisation of Europe, Japan and China and it appears we have growth coming back. This is again a reason to reduce QE. Thus, the market expectation is that the losers would be the ones who benefited the most from QE, i.e. emerging markets and bond markets.

Now, our original premise of low growth globally is based on the fact that a tightening of liquidity will automatically lead to a reversal of a lot of factors supporting this growth and hence there will be a lower incentive to reverse QE. This factor reversal is starting to happen.

The actual growth rebound is only marginal

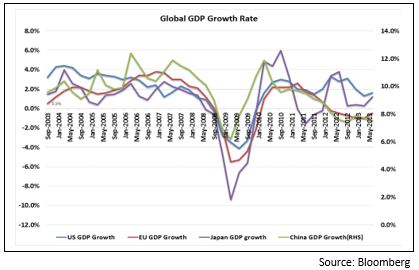

Except for Japan, where there is a genuine belief in Abenomics leading to a growth rebound, the other economic blocks have only had a marginal rebound. In fact emerging markets are showing no rebound. The chart on the right shows the GDP growth trends in the four large global economic blocs.

Thus the incentive for the Fed to taper QE should be dampened.

The US labour market and new job creation are not as healthy as they look

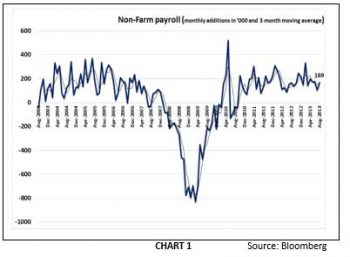

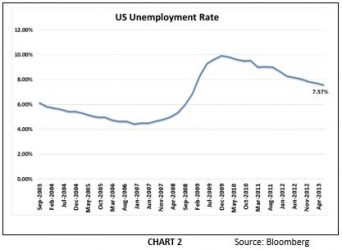

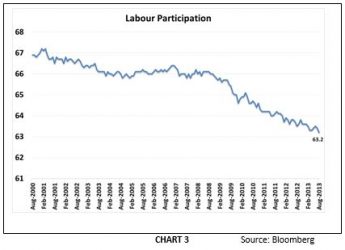

New job creation in the US has been looking poor and has surprised on the downside (see chart 1 on the right). In the last few months there have been strong downgrades to initial official estimates of new job creation. Unemployment numbers are slowly improving (see chart 2 below) but for the wrong reasons – more people are giving up looking for jobs, evidenced by US labour participation being at a 36-year low (see chart 3 below right).

Hence the unemployment data looks better than it really is. The broad point is that the US labour market has hardly improved. The whole point of QE was to improve this; if this has not been achieved, why reverse QE in a big way?

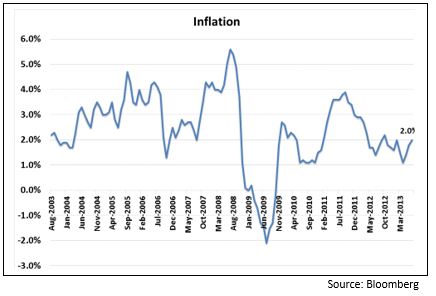

US headline inflation is not yet a problem

Inflation, which is normally a driver of a tightening cycle, is not yet a problem (see chart below).

Hence while the factors which were targeted by QE (i.e. labour market and GDP growth) have not improved significantly, pressures are building up to further dampen both these factors.

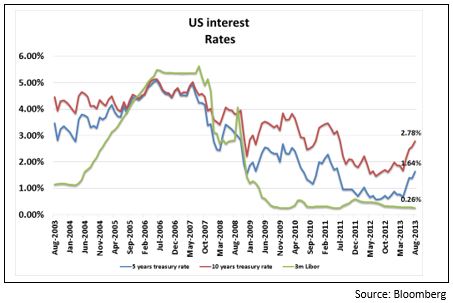

Long term interest rates are shooting up

Much before the US Fed raises rates, the market-driven long term rates are already shooting up (see chart below). This has also been aided by emerging market central banks becoming net sellers of treasury bills (as they have to defend their weakening currencies). This increase in long term rates is happening at a time when the ratio of US government debt to GDP has doubled over the period 2009 to 2012. No one wants to consciously increase interest rates when one’s debt has doubled. But that is what the market expects the US to voluntarily do.

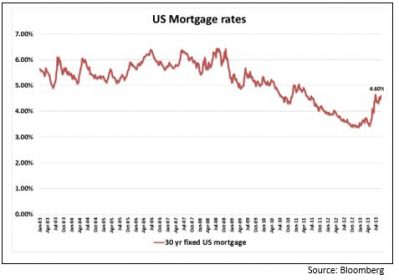

The US housing market is suffering

30-year mortgage rates have spiked up (see chart on the bottom left). Combine that with the sluggish US labour market mentioned earlier and it is not surprising that the US property market is suffering.

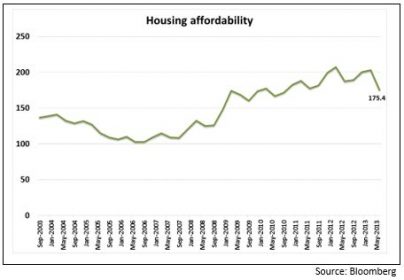

Consequently US housing affordability, which had improved dramatically since 2009, is coming off sharply (see chart on the bottom right).

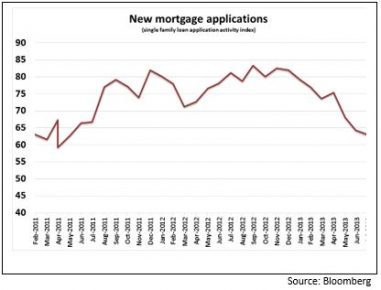

Mortgage activity (both refinance and new applications) is coming off very quickly and is reaching 2011 bottoms (see chart below). This is a precursor to slower housing activity.

New US housing construction starts are already 10% below the peak in March 2013. Sales are showing the first signs of coming off (see chart below). Though both these numbers are way below the 2007 peak, they already have head winds building up against them.

The conclusion is that the US housing market is slowing down. This was one of the primary sources of the GDP growth rebound since 2009 and now that source is weakening.

Conclusion

Though we do believe that the US long term interest rates are at the bottom of a 30-year cycle and they will need to go up, this will be a slow and arduous process and will not happen without a significant increase in inflation. Through all this, GDP growth will remain weak.

We therefore believe that there is a high likelihood of the QE tapering trade losing momentum.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.