This being River Valley Asset Management’s first newsletter, I thought it might be useful to re-iterate and add more substance to some of the underlying macro thoughts guiding our portfolio construction process.

The Central Banks want you to take risks

The FED and its fellow central banks will continue printing money and buying bonds. This will keep interest rates low for the foreseeable future. The FED is saying that it does not want you to be a “rentier capitalist”…..what in India is referred to as a “zamindar”. Who is a “rentier capitalist”? Lenin describes him as someone who “clips coupons, who takes no part in any enterprise whatever, whose profession is idleness”. Such an investor will earn very low nominal returns and negative real returns. In short, the Fed is forcing us to take risks i.e. move into equities.

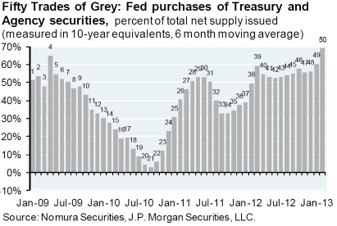

The Fed has been, by far, the largest buyer of US treasuries in the 50 months since the 2008 crisis. It has bought 55% of the treasuries issued since then and 70% of those issued in the last 6 months. Without the FED buying, treasury yields would be very different.

On the other hand, global portfolio positions are at a high in terms of fixed income holdings. This is a 30-year old love affair and separation is not going to be easy.

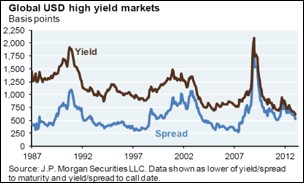

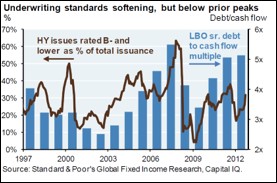

The first move by the market in terms of increasing risk exposure is to go into the high yield bond market. Their nominal yields are at historic bottoms but risk spreads are still at long term averages. Hence, there continue to be opportunities in this market….though fast vanishing. Also, the market is buying higher risk bonds as can be seen from the increase in higher risk bonds as a proportion of total issuance.

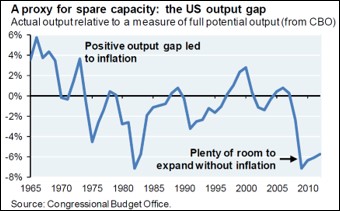

The Fed can keep rates low for some time

The only end to the low rate environment can come from higher inflation. But inflation in the US (and all of the developed world and a part of the EM world) will not go up in the medium term as there is adequate spare capacity in the system.

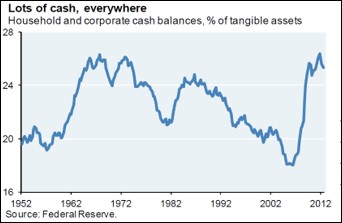

Companies globally have a lot of cash

In this push towards risk and away from cash, the stand-out entities are corporates across the world (with the possible exception of markets like India). Corporates have been hoarding cash and are generating strong cash flows. This increase will benefit debt holders as much as it will benefit equity holders. That’s where our investment hunt for cash-rich, cash-generating companies with moderate growth fits in.

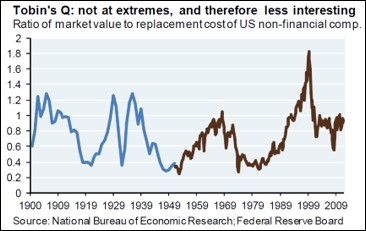

Valuations at long term averages

Given the fact that we are at a historic low in terms of cost of funds, asset prices would have been expected to be nearer the peak. This is not so. Hence valuation by itself is not a concern. But earnings visibility and sustainability remain concerns.

Interesting thought for the month

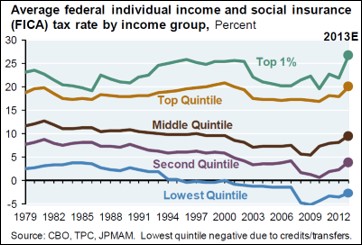

Currently the US is the most “socialist” it has been in the last 35 years. The ratio of the total tax rate for the top 1% of income earners compared to the bottom 20% (quintile) is at its peak.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.