Volatility is not Risk. This is a subject and concept which cannot be over-emphasized. With markets looking like reaching a short term peak, our belief in this concept could be tested sooner than we realize.

Just to start off, a quote by Charlie Munger, Warren Buffet’s business partner, would be apt.

”Using [a stock’s] volatility as a measure of risk is nuts. Risk to us is:

1) the risk of permanent loss of capital, or

2) the risk of inadequate return.”

Similarly, John Boggle (CEO and Founder of Vanguard Funds) recently said:

“Betting on value is an important way to own assets as compared to trading on stocks. There are far too many people speculating on stock price and very few focusing on business value.”

The former (i.e. stock price) – is related to volatility and the latter (i.e. value of the underlying business) – is related to real risk. In the long term the volatility becomes less relevant, whereas in the short term the business risk is less relevant. Hence, since our investment strategy is to make money from buying the right businesses at the right price, we need time on our side.

There are various reasons why volatility is referred to as “risk”. The two primary reasons are:

- Volatility is more easily measurable. The financial and economic world has a fetish for false precision, i.e. to be exactly right about the wrong parameter.

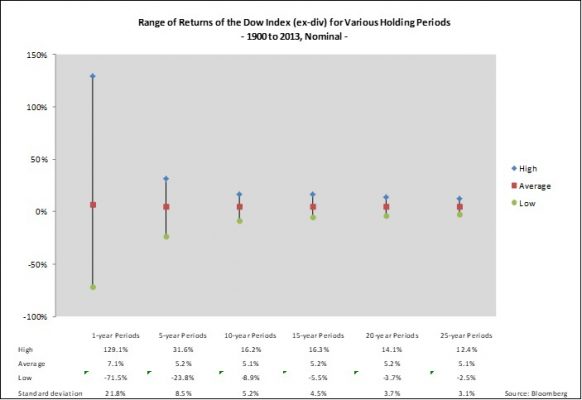

- The duration mismatch between traders and investors. For a trader, volatility is risk. But for an investor (who is differentiated by a longer time horizon than a trader), the underlying business risk is more important. As the duration is increased, one becomes more exposed to the business risk and return. But if the duration is short, one is more exposed to trading returns and volatility risks. To illustrate this point, look below at the long term return and volatility chart for various holding periods.

As can be seen from the table above, though the average return over the various holding period remains around 5-7%, the dispersion of returns starts narrowing with an increasing holding period.

A lateral point in this risk/volatility discussion is that price volatility in itself is not risk, but true risk is often in how people react to volatility when it occurs.

It is important to make a distinction between emotion-driven price volatility versus permanent deterioration of a company’s long-term fundamentals. Competent mountain climbers and dividend growth investors both recognize that the only way to get to the highest peak is to be willing to traverse the occasional valley along the way.

The whole point of this “discourse” is to emotionally prepare ourselves for future price volatility and guard from confusing it as risk.

Thought for the month

On the 5-6th April 2013, I attended the first Global Pan IIM Alumni Event. The Indian Institutes of Management (IIMs) are leading business schools in India and their Singapore-based alumni have been hosting business events with the support of the Singapore government since 2005.

This event was supported by EDB; it had the Deputy Prime Minister of Singapore as a guest of honour and 800 attendees from all over the world. The IIMs have a distinguished set of alumni in Singapore, including Piyush Gupta (the CEO of DBS), Dr. Raghuram Rajan (the Ex-IMF Chief Economist, Professor at Chicago School of Business and current Chief Economic Advisor to the Government of India), Sunny Verghese (Group Managing Director & CEO of Olam International) and many others. There were a variety of panel discussions and talks during the two-day event. I would like to share a few interesting “nuggets of wisdom” from some of these speakers.

“The current world is knowledge-surplus and insight-deficit”.

“Best practices will keep you in the middle of the pack, as everyone is striving for it. ‘Next practice’ and innovation are what you need”.

“The culture of a company always trumps strategy.”

“Think local act global….not the other way around”.

“India’s institutions have not kept pace with its growth. Once the institutions catch up, growth will re-accelerate.”

“India has too much ‘law’ and no ‘order’. China is the other way round.”

“Asian customers are moving from being ‘time-rich, cash-poor’ to ‘cash-rich, time-poor’. This is going to be great for the services sector.”

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.