The standard negative narrative on China currently is that we are witnessing a structural break from the rules of engagement of the past 3-4 decades. Many would therefore say this makes China an un-investible market. The structural elements of this construct include a permanently altered geopolitical environment and an irreversible demographic downturn. Add to this a life-threatening property down turn and question marks on the relevance of the private sector in the Chinese economic dispensation and we have a complete picture of this negative narrative.

Our understanding of what China is going through now is different in a subtle but important way. We have a different construct in terms of how to look at what is happening in China, especially in the past five years.

Our construct is that China is undergoing a painful “detox” restructuring or, as economist Joseph Schumpeter would say, “Creative Destruction”. The structural issue of geopolitics and demographics remain, but we believe their impact is over-emphasised in the shorter term. The medium-term issues of the property sector and the role of the private sector is where the Creative Destruction is happening. We make the case that, from the perspective of economic momentum, corporate earnings and equity market returns, these latter two factors are a lot more important.

Also, most importantly, we feel these two negative factors are seemingly bottoming out.

The Property Sector Reset: Not Simply A Detox But A “Cold Turkey”

The correction in the property sector, which is now nearing its 3-year anniversary, is potentially one of the largest sectoral resets in any large economy in terms of both the magnitude and the speed. Before we give more details on this correction and why we think it might be on its last legs, we want to make an additional point. The point here is that a lot of the other negatives that the media and markets keep mentioning flow directly from this reset. Some of these derived problems are:

- Deterioration in local government finances: A large chunk of the local government fiscal receipts was from land sales. With the sharp drop in land sales, local government investment projects have slowed down dramatically, employment generation has slowed and, most importantly, their credit ratings have deteriorated dramatically.

- Upstream and downstream industries have shown a sharp drop in demand: Upstream industries like cement, steel, construction machinery, etc. have been seeing a sharp drop off in demand. Similarly, downstream industries like white goods, property services, etc. also are seeing soft demand.

- Poor consumer sentiment: At 70%, the largest component of household saving in China is their property holdings. With the correction in property prices of the past three years and no light at the end of the tunnel, the wealth loss is significant. Combine this with poor stock market return, low rates in the fixed income market and an uncertain job market, and we have the perfect storm for consumer confidence.

We feel these (and more) weaknesses in China will reverse once the property sector shows a bottom. Obviously, it will happen with a lag and probably be spread over a few years, but these negatives will dissipate once the property sector improves. Hence, our attempt below to analyse the property sector downturn and look for a bottom there.

Crashing Property Sales

The chart alongside shows the extent of the drop in new residential property sales. The annual run rate has dropped by about 45% from the peak in Jun 2021. The current run rate is back in absolute terms to levels last seen eight years ago.

In terms of property sales as a percentage of GDP, the picture is even starker. This ratio has dropped from about 17% of GDP in June 2021 to about 7% in March 2024. This is a level near the bottom seen in 2008 and near a 20-year low.

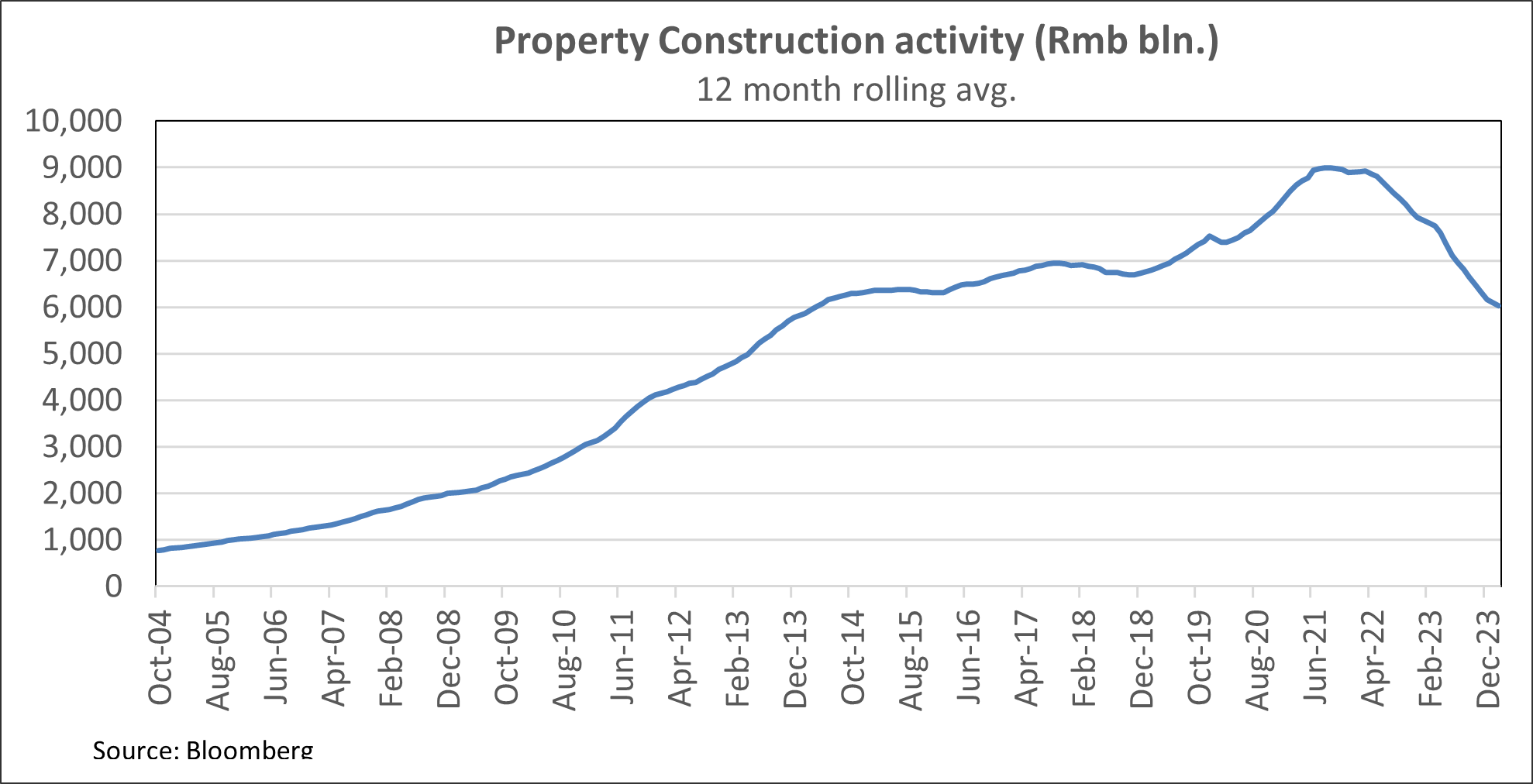

Sharp Drop In Construction Activity

Another metric, construction activity (which has a direct impact on GDP), is at a 10-year low. Given the fact that it lags property sales, this number can keep dropping for another 1-2 years after property sales bottom out. Also, this is a 33% drop from the peak in 2021. Residential property construction as a percentage of GDP has dropped from 10% in 2014 to less than 5% now, a level not seen in the past twenty years.

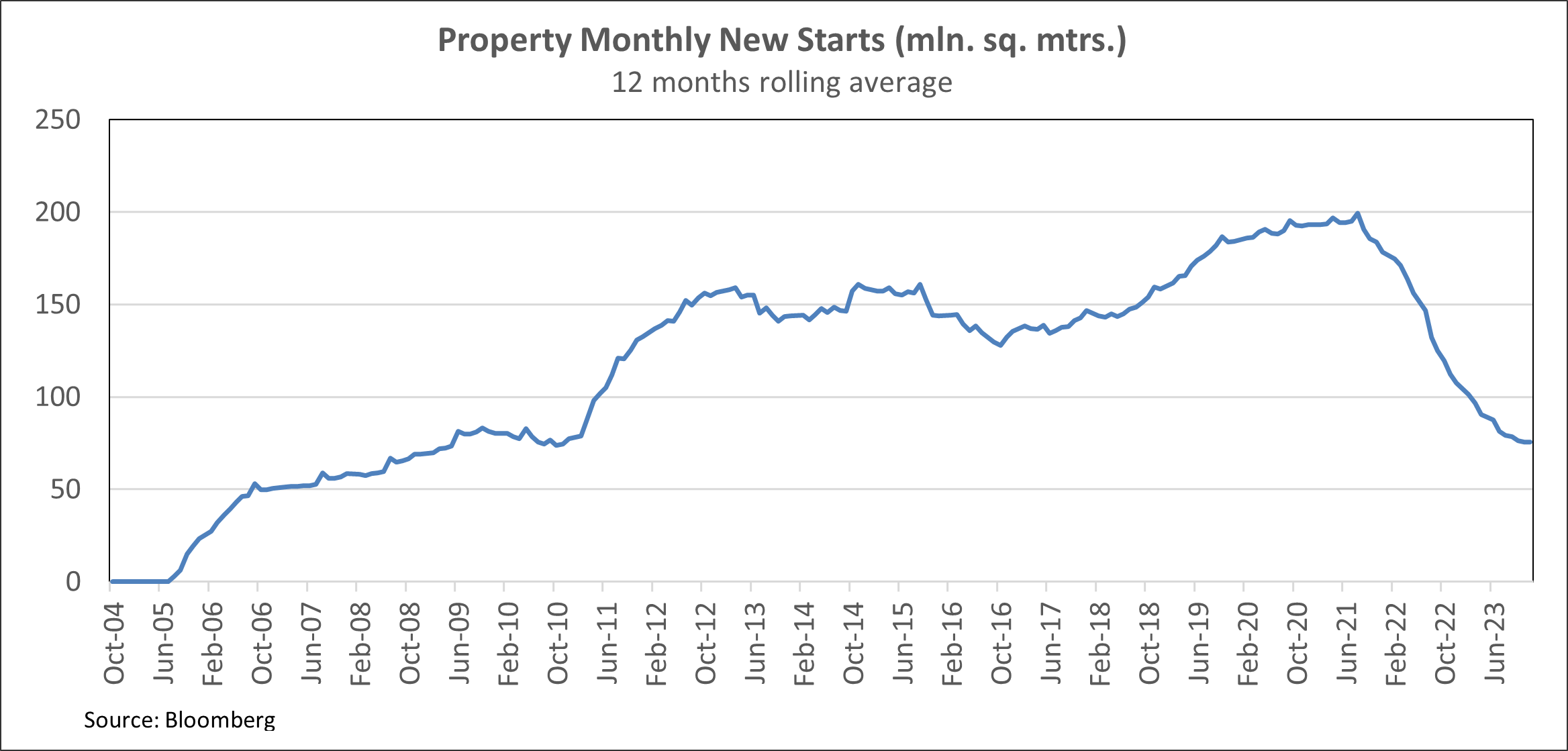

Property New Starts at 15-Year Lows

Finally, we look at new starts. Here, the drop from the peak in 2021 is over 60% and the current run rate is at levels last seen in 2008-09. This is a precursor to a sharp drop in supply in the coming years. In the near term, this manifests in very low levels of land purchases by the developers and the consequent stress on local government finances.

Seemingly, these three factors paint a dire story. But our take is that they paint a picture of a correction that is on its last legs. Even the government actions/ words now seem more focused on stabilising this market at somewhere near the current level rather than continuing with its “creative destruction” phase. Since the beginning of 2023, local governments have put out over one hundred measures to ease property sector restrictions. Despite this, China still has a bewildering set of restrictions put in place over the past seven years of a slowly tightening regulatory environment. We expect most of these restrictions to slowly unwind.

Another interesting fact is the continuous rise in secondary market volumes since the middle of last year. In Jan-Feb 2024 in the twenty five major cities, secondary market transactions were 25% higher than the same period in 2022 (though 13% lower than the temporary post opening high in Jan-Feb 2023). Also, secondary market listing in major cities is 56% higher y-o-y and have been moving up steadily over the past 18 months.

This is understandable buyer behaviour given two facts. In the secondary market, there is no completion risk as is true in a lot of under construction projects. Secondly, the price correction has been larger in the secondary market, leading to a more accurate clearing price. Finally, this is also a clearing process of the virtual inventory of apartments i.e. the apartments bought in the past simply as investments.

These points lead us to believe that primary sales volumes will potentially bottom this year. This will be a 4-year correction. The lagged indicators will continue to remain negative and earnings impact of corporates based on them will take longer to correct. But the broad negative impact on the economy and sentiment will potentially peak this year. We would not be surprised if by the second half this year we start seeing positive sales numbers on the low base of last year. This has the potential to dramatically change the narrative on this front.

The Role Of The Private Sector Remains Pivotal, Though It Is Being Reset

Any one doubting the importance of the private sector in China, historically and in the future, has only to be told the 50/60/70/80/90 phenomenon. 50% of the corporate tax revenue in China comes from the private sector, 60% of the GDP in China comes from the private sector, 70% of the technological innovation, 80% of the urban employment and 90% of corporate entities are from the private sector. This is not a command economy of the Soviet kind. For sure, the definition of private sector has facets which are unique and give it a very Chinese characteristic, but it is still the private sector. A private sector which is very important in many ways.

According to a World Bank report, since 2013, China has seen a significant rise in registered firms (mostly in the private sector), businesses and farmers’ cooperatives, from 61 million in 2013 to 154 million in 2021. This growth is attributed to a significant reform initiative aimed at reducing startup costs. The vast majority of these businesses are modest but have the tremendous potential of the entrepreneurial spirit to drive economic growth. Remember, this has happened during the time of the current regime – which is supposed to be against the private sector. Hence, we do not believe that this current regime carries a radically different view of the role of the private sector.

On the other hand, for sure, the days of gung-ho oversight-free capitalism of the 2001-2012 period is gone. The hand of the government is omnipresent. Companies are expected to keep the interests of the country and party in view whilst making larger decisions and return for their investors. This was always true, with all SOEs having party representatives on their boards, but has got re-emphasised and made more robust in the past few years. Also, this presence has now been extended to larger private companies too. The implications of this are only slowly being understood and are not something the capital market is able to easily price in.

Also, in the past few months the official rhetoric has clearly turned in favour of the private sector, especially the domestic one.

On March 5th, President Xi Jinping said, “Work must be done to support the growth of the private sector and private enterprises and spur the intrinsic impetus and innovative vigour of various business entities,” when he participated in a deliberation during the second session of the 14th National People’s Congress (NPC), the Xinhua News Agency reported. His recent meeting with global corporate leaders trying to assuage their anxiety about doing business in China means that there is a consistent message coming from the top. Combine this with the work report put out on March 8th of the Standing Committee of the 14th NPC, China’s top legislature, where it pledged to accelerate the formation of a law aimed at promoting the development of the private sector, and it sends a fresh signal on policymakers’ commitment to making continuous improvements in the business environment and boosting the high-quality development of the private sector in China.

In short, the broad signalling has clearly turned positive. But, as is typical in China, once in a while some regulatory action will be made which will put a question mark on the seriousness of this pro-private sector narrative. This is usually a result of an overzealous mid-level executive decision in some department in the government apparatus. Often, this is to fulfil some unconnected regulatory push which might be at cross purposes with this pro-private sector top- down narrative. But, with time, this will get smoothened out.

Obviously, the reset creates uncertainty and new winners and losers. The whole tech sector has reset its profitability and market dynamics. Each vertical in this sector has become less monopolistic. Also, profit focus has to be tempered with a consciousness of the impact on the society as a whole. But once this reset is put in place, the companies are free to maximise return for their investors.

Let me leave you with a surprising case study to illustrate the above point. One of the poster children of the high handedness of the Chinese government against the private sector was how they “wiped out” the online education sector for school kids. Overnight, the rules were changed such that the business design of a lot of these companies became unviable. The reasons given for this draconian action was the negative impact these services were having on school-going kids.

But what happened to these companies? Did they die? Did they morph and survive? One example is of the top company in that sector in 2021, New Oriental Education (EDU). When these new regulations came in, its stock price dropped from USD 180 in Feb 2021 to USD 18 in Aug 2021, a 90% drop in six months. But what has happened since then? EDU’s profit and earnings, after a precipitous drop, have strongly rebounded. For the current year, the revenue and profit will be 15% higher (!) than the pre 2021 peak. Its business is still in online education but has pivoted away from the sectors the government was concerned about. This is what we mean by the private sector “reset” and Joseph Schumpeter’s Creative Destruction we mentioned earlier.

Cover photo by zhang kaiyv on Unsplash

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.