China is coming back strongly from the Covid-connected lockdowns, if recent mobility data around the Lunar New Year period and January are any indications. We have been flagging a recovery in China for some months and we are finally beginning to see it gain hold at the ground level across many sectors. Many companies that have been visiting conferences in January have spoken of demand recovering off the floor of 2022 and are voicing guarded optimism that this ought to gather steam as we go along.

The Hang Seng index is up 10.4% in January alone and 49.6% at the end of January 2023 since the bottom on October 31, 2022. This is bringing in a sense of caution among the bulls while the sceptics (of which there are many yet) believe it is no more than a reopening-driven rally and that this will eventually fade away. Yet, both admit that beyond the index-hugging purchases and the sentiment-driven tech and Internet names, there is a pile of stocks that lies abegging in the Hong Kong market at deep discounts to their fair value, which makes it a veritable value investors’ paradise. Many of them do tend to be small-caps with liquidity that large institutional investors could struggle to action, but there are quite a number of large companies in the mix too that trade at -1SD or even -2SDs off their long-term averages, with durable dividend yields of 5-10%. To add to that allure, several of these have cashed-up balance sheets where net cash can be anywhere between 20-50%, or even more in some cases, of their current market capitalisations. While some have good reasons to be treated shabbily by the market, others have been victims of the brutal bear market and China’s own self-inflicted wounds of the past two years.

This month, to illustrate this point, we have chosen to highlight two names that fit that description for the most part.

Sinotrans

The reason for choosing this name over other larger companies is to show precisely what lies beneath the laundry list of large-cap institutional broker-covered stock universe and where true value lies. Sinotrans (0598.HK) is a true-blue logistics company that straddles every major part of the industry. Its business is split into three parts: the core Logistics (including contract, chemical, projects, cold-chain and others); Freight & Forwarding and related business (including Sea FF, Air FF, Railway, Shipping Agency and Storage and Terminals); and finally e-Commerce (cross-border e-comm, e-comm platform logistics, equipment sharing platform). In addition to this, Sinotrans owns 50% of the JV with DHL (DHL Sinotrans Air Courier Ltd) for China-related international deliveries which is equity accounted in its accounts.

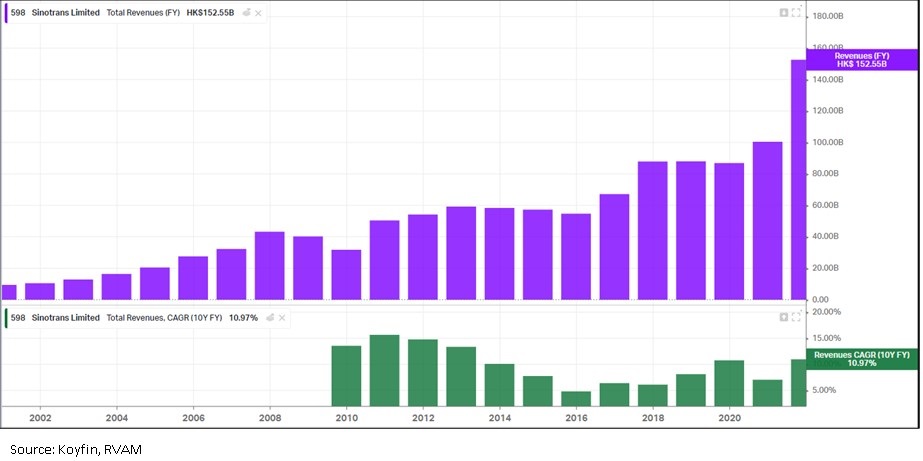

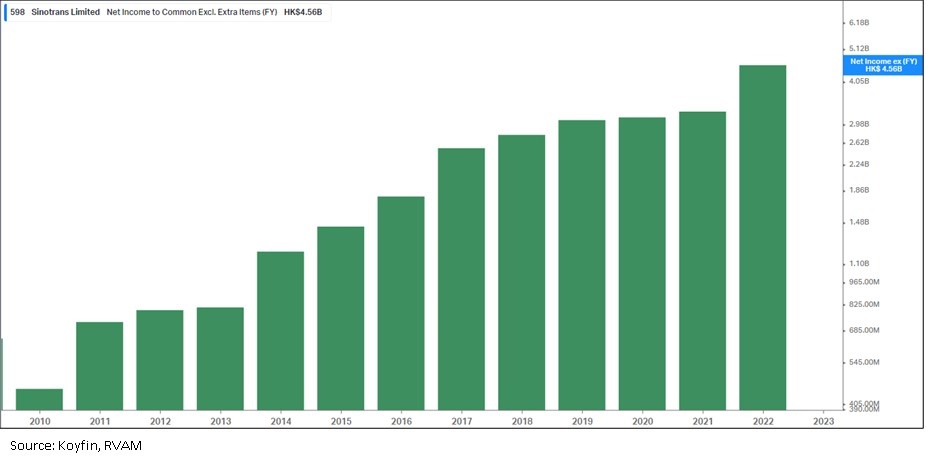

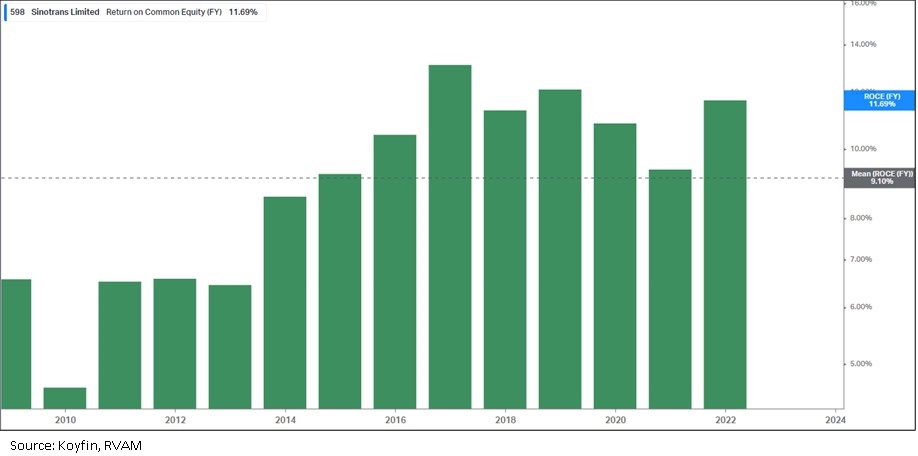

One would not be wrong to assume that a logistics operator would have been buffeted by a weak economy, alternating opening and shutting down of parts of the economy, supply-chain disruptions at ports, etc. Well, the reported numbers speak for themselves. Sinotrans has performed admirably over the last ten years with even the Covid years appearing no more than a stumble in its growth path. In a highly competitive and mature economy like China, this must be commended.

The stock trades in Hong Kong. The stock price bottomed at HK$ 1.86 at the end of October 2022 and has since risen off those lows to c.HK$2.70 today. As is evident from the chart above, even after this price recovery off the troughs, the stock still trades at -1SD its long-term averages on P/E and EV/EBIDTA multiples. On Price to Book it has recovered to around 1x book for a RoE that averages about 9% – not a very flattering figure, but not too bad either for an asset heavy business. The dividend yield at current prices is a compelling 7% plus. All these numbers are based on 1-yr forward estimates. To top all this, the crown jewel is its JV with DHL, which brings in almost 40-50% of the profits before taxation for the company. Clearly if one were to dice the earnings and value Sinotrans separately, it would be valued much higher than what the market currently values it at.

The market has overlooked the strength and durability of Sinotrans’ business for quite some time now. The management’s communications are sparse and could do with improvement and the analyst coverage is thin and infrequent. All said, we believe Sinotrans is a classic case where even a mere mean reversion of valuations can provide a further 40-50% upside over the next one year.

Sinotrans is one example of a value-stock, but the company that has intrigued us for a long time and where the action is just getting started is Brilliance China.

Brilliance China

Brilliance China is now, for all practical purposes, a holding company. Under the hood lies its 25% stake in BMW Brilliance Auto (BBA), the joint venture through which BMW conducts most of its business in China. It used to be 50% previously, but they sold 25% back to BMW in exchange for which they received a truckload of cash that sits on its balance sheet today. The story begins from there.

Now, before you groan in protest about corporate governance issues at Brilliance, we would urge you to pause and read on to understand the extent of the absolute and utter apathy investors have accorded this company. Since this is not an operating company, the value lies in the balance sheet. To extract this value, we will have to put a modicum of faith in the recent utterances of the management, by its chairman at its last AGM for starters. We concur that much can go wrong yet and it all comes down to the good intentions of the board of directors. The board has clearly not covered themselves with glory in the past. Yet, our interest is piqued now. Here is why.

A good place to start is to count the cash lying in different places that shareholders of Brilliance can lay claim to, and also to fathom the amount that comes through the door via its 25% stake in the JV with BMW in 2022 and beyond. The starting point to remember is that the market cap of the company is CNY 21 bln @ HKD 4.8/share current price.

Cash on balance sheet: Because of the sale of half its holdings in BBA in early 2022, the company has CNY 18 bln. of net cash. This is about HKD 4 per share.

Net cash at BBA: As of June 2022, BBA has net cash of EUR 8.8 bln. on its balance sheet. Brilliance’s 25% share of this is CNY 16 bln., another HKD 3.7 a share.

Annual earnings from BBA: BBA is highly profitable. The current run rate of net earnings from Brilliance’s 25% stake in BBA is CNY 7.5 bln. per annum. This is an annual earnings of HKD 1.7/share. We can value these earnings in different ways. If we simply put a 5-times multiple, it would be HKD 8.5/share of value. To put it in context, these earnings have nearly doubled in the past five years. Even if we look at 50% pay-out ratio by BBA, the annual cash earned by Brilliance from this dividend would be HKD 0.85 a share. This, if paid out by Brilliance, would be 17.7% annual dividend yield.

Just adding the above three parts results in over HKD 16/share. This is about 3.3x the current share price of Brilliance. Brilliance in January declared a HKD 0.96/share special dividend to be paid in February, so this cash has slowly started coming to the investors.

The question to ask is why the stock price is so low given the above math. The answer is simple: the market is not sure what proportion of this cash will come to the minority investors. Despite the protestations of the management that they are going to be very disciplined, the market will show value only when the cash actually comes to the investors. 33% of Brilliance is held by an entity of the Liaoning provincial government. This government is tight on cash. The market fears that the board will be under pressure to use all this cash to buy assets from the government. But as the company pays out dividend, this risk will be mitigated.

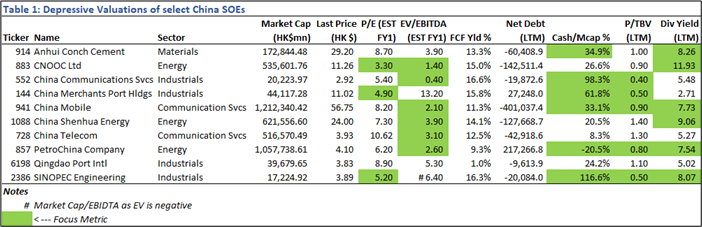

It is worth noting that there are a bunch of SOEs which have been on the “sanctioned” list of the U.S. Government at the height of the U.S.-China acrimony under President Trump. Those sanctions prevent U.S. investors from investing in them and hence have robbed them of a large pool of western capital flows. In turn, they have been rendered as virtual stock market pariahs and their valuations beaten down severely. We have no way of telling when these sanctions will be lifted, but since these companies are virtual monopolies in many cases, they continue to grow, even though it might be at slow growth rates, generate copious free cash flows, pay hefty dividends (and can pay more) and have cash overflowing from their balance sheets after meeting all their capex and dividend obligations. Despite their gigantic sizes, they are the proverbial moon shots for investors with a long time frame of investing, where the dividend yields on offer provide enough for one to wait for the big shift in corporate action/sentiment to happen.

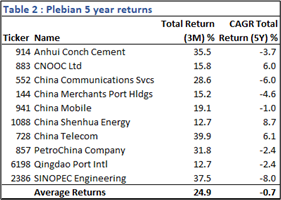

Like Sinotrans and Brilliance, other stocks which pique our interest are encapsulated in the table below. Note the following:

- The cells marked in green highlight those metrics which reflect extremely low values/valuations.

- Note from Table 2, that in spite of the ~20-25% lift-off from the October-November 2022 lows, the valuations in Table 1 are still very low

- In many cases, the 3mth returns are still less than 20% in spite of the strong rally in the HSI Index.

- We have excluded banks and financials, due to different sets of metrics that apply there, but which make for similar depressed readings.

Sources for both tables: Koyfin and RVAM

Conclusion

We conclude that the China rally is at the end of the first leg, focused on simply a risk off trade. Though valuations at the index level are still cheap, they are not as deep as they were three months ago. But there is a large group of former darling stocks which are still bouncing around multi-year lows and are also very cheap in absolute terms. Some of them are permanently damaged businesses, but some of them are not. The next leg of the rally would be driven by earnings upgrades and some of these companies might create the new market leadership. We have our eyes and ears open for that.

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.