A few months ago, the GameStop/ Robinhood episode brought into focus something that many large investors (the institutional kind mostly) had resisted accepting as a force driving the markets. Much has been said about that particular event and bears no further comment from us, but what it did emphasize strongly was that the role of retail investors from Tokyo to New York had suddenly and perceptibly changed the pattern of trading on stock exchanges around the world and impacted stock returns in specific sectors and areas of the market like never before. It also brought home that it would be puerile to dismiss this as transitory and something only to do with the pandemic that would go away once we got rid of it.

It was not just the sheer increase in trading volumes that has palpably moved many markets. The use and proliferation of information and opinions via social media have added a hitherto unknown dimension to trading activity today and likely for times to come.

Source: BIS

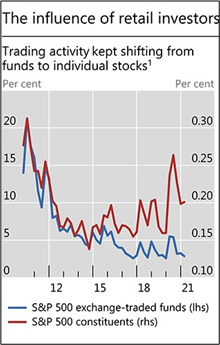

Small traders/ investors are often attracted by the speculative nature of single stocks rather than by the diversification benefits of indices. Consistent with such preferences gaining in importance, turnover for ETFs tracking the S&P 500 has flattened over the past four years, while that for the S&P 500’s individual constituents has been rising in the same period. Data points to 2017 as the possible germination of retail investors’ rising influence.

Retail investors are also more likely to trade assets on the basis of non-fundamental information. During the late 1990s tech boom, for instance, they often responded to important news about certain companies by rushing to buy the equity of similarly named but different firms or firms from the same sector or sub-sector. Comparable patterns emerged in early 2021, for instance when the value of a company briefly rose two to five-fold as investors interpreted a social media message as endorsing its stock. However, there are other reasons more germane to each market for the rise of retail investor participation. Below we discuss a few markets where country-specific and market-specific reasons present a cocktail of forces that are much longer term in nature and which could impact trading on stock exchanges as we have known it.

Thailand: Retail, The Bulwark Against Foreign Selling

Aside from the factors that hold true globally, such as momentum bias, Thai investors face a paucity of alternative vehicles for their abnormally large excess savings. We identify broadly three reasons for this:

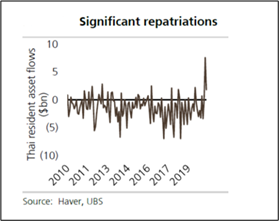

- Asset repatriation: Thai residents repatriated $9.4bn of assets, equivalent to c.2% GDP, previously held abroad, by mid-2020 alone, most likely driven by the increased home bias seen during crises. This pool of savings needed to be re-invested and has played a role in the subsequent months’ support to the market.

- Gold prices: Thais, like several other Asians, have a cultural bias for gold as an investment vehicle. However last year Thailand saw over $3.5bn in gold sales, the largest outflow seen to date. Whilst a portion of this can be explained by the need to tide over short-term income disruptions, it is believed that the large majority was due to investors capitalizing on elevated gold prices. Such excess capital also needed to be re-invested and much of it likely found its way into equities either directly or through mutual funds or some other investment vehicle.

- Deposit rates: The 12-month bank deposit rates have fallen by over 80bps since the beginning of the year to below 50bps, largely due to liquidity support measures from the Bank of Thailand. At such record low deposit rates, it is only natural to expect some capital moving into equities seeking higher returns. It is well understood by investors that Thai companies have a culture and discipline to pay out generous dividends when warranted and supported by earnings. This assures Thais of receiving stable dividends especially from large SOEs, banks and oil companies generally.

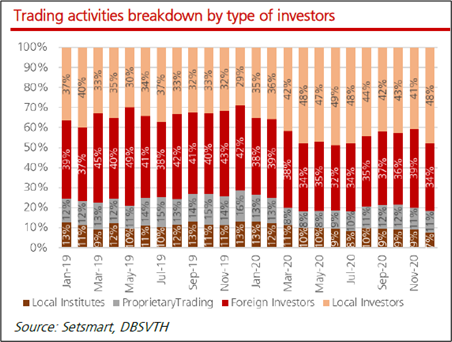

In 2020, foreigners were net sellers, with net sales of Bt264.4bn. Local retail investors, local institutional investors, and local brokers’ proprietary portfolios were all net buyers, with net buy positions of Bt216.7bn, Bt33.5bn and Bt14.2bn respectively. Foreign + non-voting depository receipt (NVDR) holdings in the Thai market dropped steadily to c.25.8% currently compared to its peak of 36% in 2012. The local investors and proprietary traders account for c.60% of trading volumes today versus 49% at the start of 2019 and possibly much lower earlier. Few other markets can boast as strong a domestic support for the market as the Thai market offers.

Malaysia: The Gloves Are Off, For Now

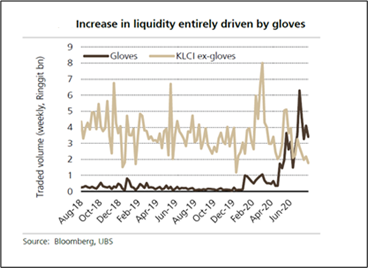

In 2020, retail investor net inflows into the market were RM14.2bn and this continued into 2021. But there is a peculiarity to this surge, unlike elsewhere in Asia. Retail investors in Malaysia mainly bought glove manufacturers and some consumer discretionary and financials as the pandemic broke out. As a result, KLCI trading volumes increased to RM5-7bn/week in 2020 from c.RM3bn/week a year ago, entirely due to focussed trading in the top 3 or 4 glove manufacturers like Top Glove and Hartalega where volumes increased 10-15x. Oddly, the trading volumes for KLCI excluding the glove manufacturers have declined. (See accompanying chart)

Bursa Malaysia’s average daily traded volume (ADTV) in 2020 was mainly driven by the increase in retail investors’ participation (37% in 2020 vs 24% in 2019). The proportion of online trades increased to 80% in 2020 from 62% on average between 2013 -2019.

Since the start of 2021 though, as the nature of the spread of the pandemic has changed, the pendulum has swung 180 degrees and the effusive love for glove manufacturers has been replaced by that for the technology sector.

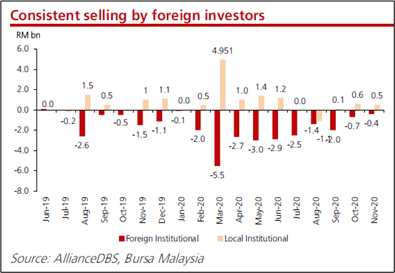

From the accompanying chart it is apparent that the quantum of domestic buying has been insufficient to balance the selling by foreigners, who have been net sellers in Malaysian equities through 2020 and 2021.

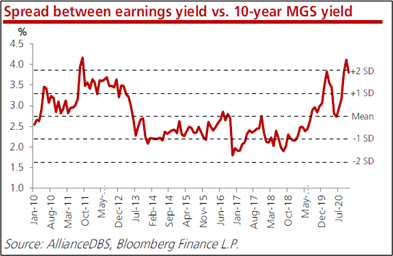

It was also the case that the yield spread between equities and the 10-year MGS has escalated to close to two standard deviations above its long-term mean level, giving retail investors another strong reason to be gravitating towards equities.

Indonesia: Foreigners Rule The Roost

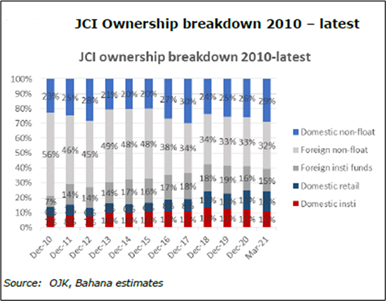

Down in Indonesia, according to IDX, in 2020 the ADTV grew 3x to c.USD1.5bn/day driven by the doubling of retail participation to 70% while foreign participation halved to 18%. Average daily retail value transactions rose c.6-fold in this period. The widening of the retail base is apparent in Indonesia just as much from the recent data. There is also data which shows more young retail investors coming into the market and a growing number of online brokerage accounts.

Yet Indonesia it must be said, has among the lowest retail ownerships of its stock market at just above 8%. This figure has actually declined in 2020 from a peak of c.10% in 2018. Data from the IDX shows that retail investors tend not to focus on small-cap stocks and that 56% of all trades by value are in large cap stocks versus 60% in 2018-20 on average, which intuitively seems surprising given small investors often trade in smaller local companies they tend to be familiar with. This does not seem to be the case in Indonesia.

Low level of stock ownership and narrow participation of retail investors in a handful of large stocks has created a market with low depth in liquidity and in domestic retail support. While the aggregate domestic ownership (retail and institutional) has been increasing slowly, it remains low. As a result, the market is prone to sharper moves in either direction when foreigners turn buyers or sellers, compared to other markets where domestic institutions and retail investors’ participation runs deeper and broader and offers the much-needed support. Market pricing inefficiencies abound and therefore persist for protracted periods of time.

Singapore: The Comeback Kid

Singapore has been one of the best performing stock markets so far this year. While the SGX has seen its share of increase in retail trading volumes, the bigger reason for the STI’s strong performance so far has been Singapore’s demonstrably strong handling of the pandemic, which has endeared it to the local punter and foreign investor alike. As the economy has gradually opened, domestic and international investors’ confidence has returned. Singapore also has a well-developed domestic fund management industry and a sovereign wealth fund that act as buffers in stabilising the market when the chips are down. The SGX reports that retail trading volumes have nearly doubled since pre-COVID days, something that is welcome given the long period of funk in the Singapore market.

Singapore is also resident to a sizeable private wealth sector, where large pools of cash reside and are managed. Much of this is long-term yield-seeking money that finds its way into the nearly 50 listed REITs and Business Trusts. Retail investors too, like their Thai brethren, suffer from abysmally low yields on their bank deposits and have no recourse but to invest in REITs/BTs and similar high yielding stocks that abound in the Singapore market. Incremental high savings too have driven such money into the market since 2020.

Vietnam: No More The Minnow

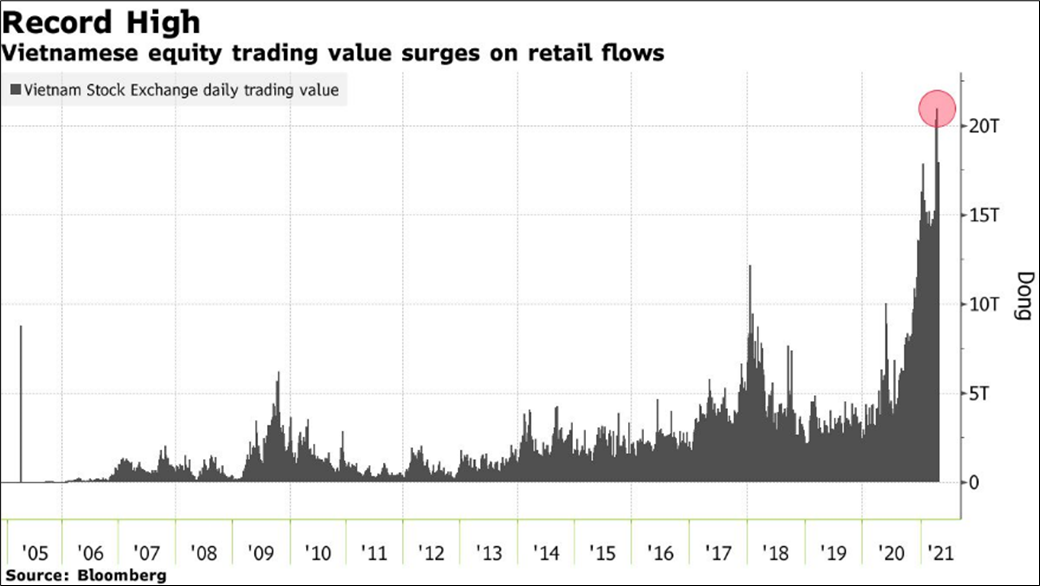

Retail investors have piled into Vietnamese stocks at an unprecedented pace, fuelling Asia’s biggest rally. The flood of local cash has seen trading volumes more than quadruple since the end of 2019. The benchmark index now includes 11 stocks exceeding $5 billion in market value, up from just two in 2015. Foreigners sold a net $876 million of Vietnamese stocks last year, similar to what has been already sold so far this year. Yet, the country’s benchmark VN Index has soared 12% since January this year, suggesting that retail investor participation and support for the market has risen dramatically today than it was even a couple of years back.

Plunging interest rates spurred ordinary Vietnamese to open nearly 400,000 new trading accounts in 2020, a record high. In the first three months of this year alone, they opened almost 258,000 more, helping send daily turnover on the Ho Chi Minh City stock exchange to an all-time high.

India: Retail Rules!

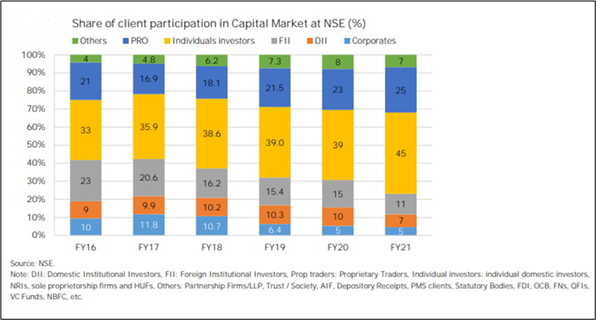

The most startling findings come from India. The participation of players in India’s stock market has changed dramatically in the last five years.

India’s markets are now dominated by individual investors, who form 45% of traded turnover of equities. Individual investors’ market share has moved up from 33% in 2016 to 45% in 2021. Note that this is pure equity cash trading and does not include derivatives trading, which itself is another huge market.

Foreign investors are only 11% of total trading volume now, down by half since 2016. Domestic Mutual Funds are now only 7% of the market, down from around 10%. Proprietary traders, which are typically the trading arms of local brokerage firms, today account for 25%. If one adds this 25% to the 45% contributed by individual investors, which is also fundamentally UHNIs and who trade across the market-cap curve, then we find that 70% of the market volume is individual and HNI investors of all ilk that drive the market volume and impart liquidity to it.

In addition to this, the National Stock Exchange (NSE) in India is the world’s largest index options market in terms of number of contracts. In the futures market, it is no different where retail has a 30% share and prop traders 40% of the traded volume.

However, when one looks at the ownership of floating market capitalization (non-promoter) equities, the picture is quite different. Foreigners own c.43% whereas retail investors own just 18% and Domestic Institutions another c.15%.

What has all this meant for investors in India? The liquidity, coverage by stockbrokers and hence price discovery of the smallest of market cap stocks has increased by leaps and bounds. As a result, money managers thrive investing across the market cap curve with consummate ease versus most other markets in the region that hardly afford such a diversity of investible stocks.

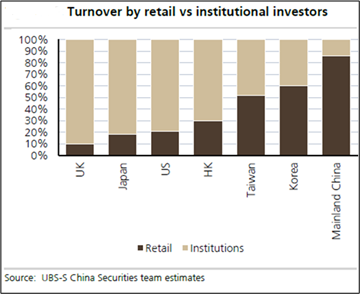

China: The Taps Are Open

A secular trend of growing Chinese household participation in the stock markets has been underway for several years now. However, given the acceleration and growing accumulation of wealth there, such trends could also see acceleration, where households seek to aggressively buy more equities in future.

Chinese households may continue to raise their equity exposure as a result of three drivers:

- Beijing continues to cap investments into the physical property markets amidst tight regulations;

- Chinese households may buy more insurance products incrementally and insurers may invest more in equities in a low interest rate environment; and

- The quality of the equity stock is improving in China with more private sector companies getting listed and becoming sector leaders and domestic champions taking on multinationals in their own backyard. Lately, growing nationalism is adding to their success. Investors are quick to identify with such companies and brands and invest in them. The massive market capitalisation of China’s technology space and more recently the growing EV space are testimony of the power of local investors’ clout.

Another fact worth noting is that residential properties account for 44% of Chinese households’ total assets at end 2020E, c.12% lower than 56% in 2000, but still a high number. While households have been trying to diversify their asset allocation, they are yet wedded substantially to property owing to the limitations imposed directly or indirectly in three probable ways:

- State ownership of natural resources limiting the investment scope of Chinese households;

- Cross-border capital control preventing Chinese households investing in overseas assets, including some of the best private sector listed companies in China; and

- Moderating growth of real economy making ROE of non-property assets relatively less attractive.

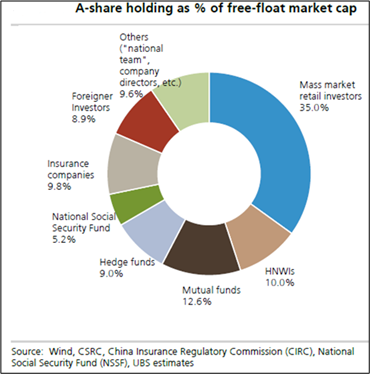

China’s A-share market ownership resembles other Asian markets like India’s where retail investors and HNIs own 45% of the free-float market cap, while foreigners own just 9%. The opening of the SouthConnect route for Mainland Chinese to buy shares in Hong Kong has only enhanced this trend further. In future, as China allows for greater North-South flow of capital, retail investors hitherto denied the opportunity to invest directly into Hong Kong listed stocks, could add a totally new dimension to trading and capital flows and have a huge impact on valuations of the same stock listed on the A-shares market and in Hong Kong.

Consequences Of High Retail Participation

It is difficult to categorically say if further “institutionalisation of markets” would possibly act as a foil to the growing influence of retail investors. Given the advent of online trading platforms, roboadvisors, ETFs and what have you, it is possible that the retailisation of markets could be a megatrend in itself that is here to stay. The trend could morph along the way as the market participation deepens and broadens further, in terms of the number of both intermediaries and investors which could grow substantially from where they are today in many markets.

Beyond the obvious consequences of ‘retailisation’ that one can think of such as higher and improved liquidity and volatility in trading, the real long-term beneficiaries of this are likely to be the corporates and investors themselves.

With liquidity comes better and more efficient price discovery of assets by markets. Large portions of the equity markets which hitherto lay illiquid and moribund as they do today in smaller markets like Indonesia, Philippines, Malaysia and Singapore, are likely to be ‘discovered’ by the growing breed of new intrepid retail investors. This ought to lead to better valuations that would spur the companies to come back to the markets to raise growth capital and even more M&A activity using their stock as currency. For investors, it would mean a wider array of stocks finding acceptance and being traded more regularly and heavily. Crucially, market inefficiencies of rank undervaluation would be shortened vastly and spur greater participation in these parts of the markets.

Today’s retail participation is often scoffed at and often referenced to in disparaging terms in the media. Yet, recent events and trading patterns have revealed that in fact, retail investors are as well-informed and diligent in their research and have sufficient money power collectively to influence stock prices, not just in the short term but even over longer periods of time. This has in fact unleashed several unintended benefits for capital markets. As such, money managers would do well to recognize the growing importance of this new yet powerful force today which is here to stay and could get stronger over time.

As we sit putting pen to this monthly, the words of America’s great songwriter and folksinger Bob Dylan, in his voice tinged with inebriation and soulfulness, ring in our ears. Arguably one of his greatest creations – The Times They Are A-Changin’ – could not be more apt at this time…

Come writers and critics

Who prophesize with your pen

And keep your eyes wide

The chance won’t come again

And don’t speak too soon

For the wheel’s still in spin

And there’s no tellin’ who

That it’s namin’

For the loser now

Will be later to win

For the times they are a-changin’

End

Disclaimer

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Information has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This information is directed at accredited investors and institutional investors only.